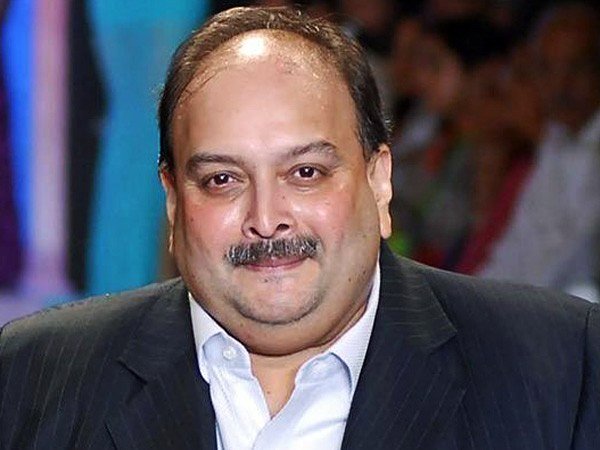

ED Initiates Restitution Of Assets In Mehul Choksi Case

The Enforcement Directorate (ED), in collaboration with Punjab National Bank (PNB) and ICICI Bank, has started the restitution of properties linked to the Mehul Choksi bank fraud case, as part of its efforts to ensure that seized and attached assets are returned to rightful owners and victims of money laundering while enabling financial institutions to monetise these assets.

The Special PMLA Court in Mumbai has approved the “monetisation of properties” amounting to Rs 2,565.90 crore, attached or seized by ED in the PNB fraud case involving fugitive diamantaire Mehul Choksi.

In line with the court order, the process of handing over these assets has begun. Properties worth over Rs 125 crore, including flats in Mumbai and two factories/godowns at SEEPZ Mumbai, have already been handed over to the Liquidator of M/s Gitanjali Gems Ltd., with further restitution underway.

The ED’s investigation revealed that Mehul Choksi, in collusion with associates and PNB officials, fraudulently obtained Letters of Undertaking and Foreign Letters of Credit between 2014 and 2017. This resulted in a loss of Rs 6,097.63 crore to PNB. Choksi also defaulted on loans taken from ICICI Bank.

To date, the ED has conducted searches at over 136 locations across India, seizing valuables and jewellery worth Rs 597.75 crore belonging to the Gitanjali Group.

Apart from this, immovable and movable assets worth Rs 1,968.15 crore, including properties in India and abroad, vehicles, bank accounts, factories, shares, and jewellery, were attached. In total, assets valued at Rs 2,565.90 crore have been attached or seized, and three prosecution complaints have been filed under the Prevention of Money Laundering Act (PMLA).

The ED and the victim banks jointly moved the special court to expedite asset monetisation. The court order dated September 10, 2024, directed ED to assist the banks and liquidators of Gitanjali Group companies in valuing and auctioning the attached or seized properties. Proceeds from these auctions will be deposited as fixed deposits in PNB and ICICI Bank.

As part of this process, six properties, including flats in Kheni Tower, Santacruz East, Mumbai, valued at Rs 27 crore, and two SEEPZ properties (Plot No. 61 and Plot No. 16), valued at Rs 98.03 crore, have been restored and handed over to the liquidator. The transfer of remaining assets is underway as per court directives.